All Categories

Featured

Table of Contents

The essential difference in between basic UL, Indexed UL and Variable UL depends on how money worth build-up is determined. In a basic UL policy, the cash value is guaranteed to grow at a rates of interest based upon either the existing market or a minimum interest rate, whichever is greater. For instance, in a common Guardian UL policy, the annual passion rate will certainly never go lower than the current minimum rate, 2%, however it can go higher.

In a bad year, the subaccount value can and will lower. These policies allow you assign all or component of your cash value growth to the performance of a wide securities index such as the S&P 500 Index. 7 However, unlike VUL, your cash is not actually spent in the marketplace the index just offers a reference for how much passion the insurance debts to your account, with a flooring and a cap for the minimum and maximum rates of return.

Most plans have yearly caps, yet some plans may have monthly caps. Furthermore, upside efficiency can be impacted by a "engagement price" set as a percent of the index's gain.

A lot of Indexed UL plans have a participation price established at 100% (significance you realize all gains up to the cap), however that can transform. Presuming you made no changes to your allotment, below's what would have occurred the following year: 80% S&P 500 Index$8,000 +24.2%100%11%11%$880$8,88020% Fixed-rate$2,060 NANA3%$62$2,122 Over this unusually volatile two-year period, your typical cash worth growth price would have been close to 5%.

Like all various other types of life insurance policy, the key objective of an indexed UL plan is to supply the economic security of a survivor benefit if the insurance holder passes away all of a sudden. Having said that, indexed UL policies can be especially eye-catching for high-income people that have maxed out other pension.

Whole Life Vs Indexed Universal Life

There are likewise essential tax implications that insurance policy holders need to be conscious of. For one, if the plan gaps or is given up with an outstanding funding, the car loan amount might come to be taxable. You must additionally know regarding the "IRS 7-Pay Test": If the cumulative premiums paid throughout the very first 7 years surpass the amount needed to have the policy compensated in seven level yearly repayments, the policy ends up being a Modified Endowment Agreement (or MEC).

So it is essential to consult an economic or tax professional that can assist guarantee you make the most of the benefits of your IUL policy while remaining compliant with internal revenue service guidelines. Due to the fact that indexed UL policies are rather intricate, there tend to be greater management costs and expenses contrasted to various other kinds of permanent life insurance policy such as whole life.

This advertising widget is powered by, a licensed insurance manufacturer (NPN: 8781838) and a company associate of Bankrate. The deals and clickable links that appear on this ad are from firms that compensate Homeinsurance.com LLC in various means. The payment obtained and various other elements, such as your place, may influence what advertisements and links show up, and just how, where, and in what order they appear.

We strive to maintain our details precise and up-to-date, but some details may not be current. Your real offer terms from a marketer may be different than the deal terms on this widget. All offers might go through added terms and problems of the marketer.

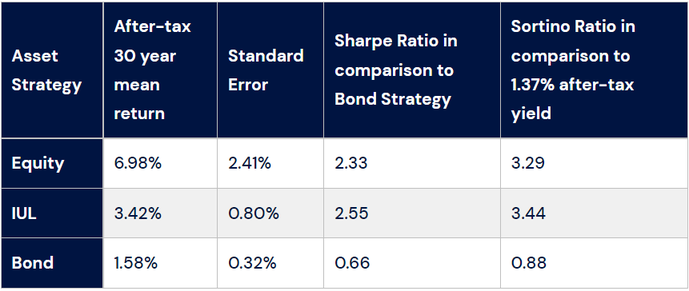

When preparing for the future, you wish to try to provide yourself the most effective possible chance for tranquility of mind, and economic safety for you and your enjoyed ones. This normally requires some combination of insurance coverage and financial investments that have great growth capacity over the longer term. So what happens if we told you there was a life insurance coverage option that integrates tranquility of mind for your loved ones when you pass along with the chance to produce added earnings based upon certain index account performance? Indexed Universal Life Insurance coverage, often abbreviated as IUL or referred to as IUL insurance, is a vibrant blend of life coverage and a money value element that can grow depending on the efficiency of popular market indexes.

Discover more concerning exactly how an IUL account features, how it contrasts to ensured universal life insurance, some pros and disadvantages, and what policyholders require to recognize. IUL insurance policy is a sort of long-term life insurance policy. It not just assures a death advantage, however has a money worth component. The defining trait of an IUL plan is its growth possibility, as it's tied to details index accounts.

Variable Universal Life Insurance Calculator

Death advantage: A trademark of all life insurance policy items, IUL policies also assure a survivor benefit for recipients while protection is active. Tax-deferred growth: Gains in an IUL account are tax-deferred, so there are no prompt tax obligation responsibilities on building up earnings. Car loan and withdrawal choices: While available, any financial communications with the IUL plan's money worth, like financings or withdrawals, have to be come close to carefully to avoid depleting the survivor benefit or incurring tax obligations.

Growth possibility: Being market-linked, IUL policies may yield far better returns than fixed-rate financial investments. Guard against market slides: With the index functions within the product, your IUL policy can continue to be shielded versus market slumps.

appeared January 1, 2023 and uses guaranteed approval whole life insurance coverage of approximately $40,000 to Experts with service-connected handicaps. Discover more about VALife. Lesser amounts are available in increments of $10,000. Under this strategy, the elected insurance coverage works two years after enrollment as long as costs are paid during the two-year period.

Insurance coverage can be prolonged for up to two years if the Servicemember is absolutely handicapped at separation. SGLI coverage is automatic for most active obligation Servicemembers, Ready Get and National Guard participants scheduled to carry out at the very least 12 durations of non-active training per year, participants of the Commissioned Corps of the National Oceanic and Atmospheric Administration and the Public Health Service, cadets and midshipmen of the U.S.

VMLI is available to Veterans who experts a Obtained Adapted Specifically Grant Real EstateSAH), have title to the home, and have a mortgage on the home. All Servicemembers with full time insurance coverage must make use of the SGLI Online Enrollment System (SOES) to mark recipients, or minimize, decrease or restore SGLI protection.

Growth Life Insurance

Members with part-time insurance coverage or do not have accessibility to SOES should make use of SGLV 8286 to make changes to SGLI. Complete and documents type SGLV 8714 or request VGLI online. All Servicemembers need to make use of SOES to decrease, reduce, or bring back FSGLI insurance coverage. To accessibility SOES, go to www.milconnect.dmdc.osd.mil/milconnect/. Participants that do not have accessibility to SOES must utilize SGLV 8286A to to make changes to FSGLI insurance coverage.

After the initial policy year, you may take one annual, cost-free partial withdrawal of up to 10% of the overall buildup worth without surrender charges. If you take out greater than 10% of the accumulation worth, the charge uses to the quantity that goes beyond 10%. If you make even more than one partial withdrawal in a policy year, the cost relates to the quantity of 2nd and later withdrawals.

The remaining money can be purchased accounts that are connected to the efficiency of a stock market index. Your principal is ensured, yet the amount you earn goes through caps. Financial coordinators normally suggest that you first max out other retirement cost savings alternatives, such as 401(k)s and Individual retirement accounts, before taking into consideration investing via a life insurance coverage policy.

Table of Contents

Latest Posts

Index Linked Insurance Products

Iul Insurance Meaning

Aseguranza Universal

More

Latest Posts

Index Linked Insurance Products

Iul Insurance Meaning

Aseguranza Universal