All Categories

Featured

Table of Contents

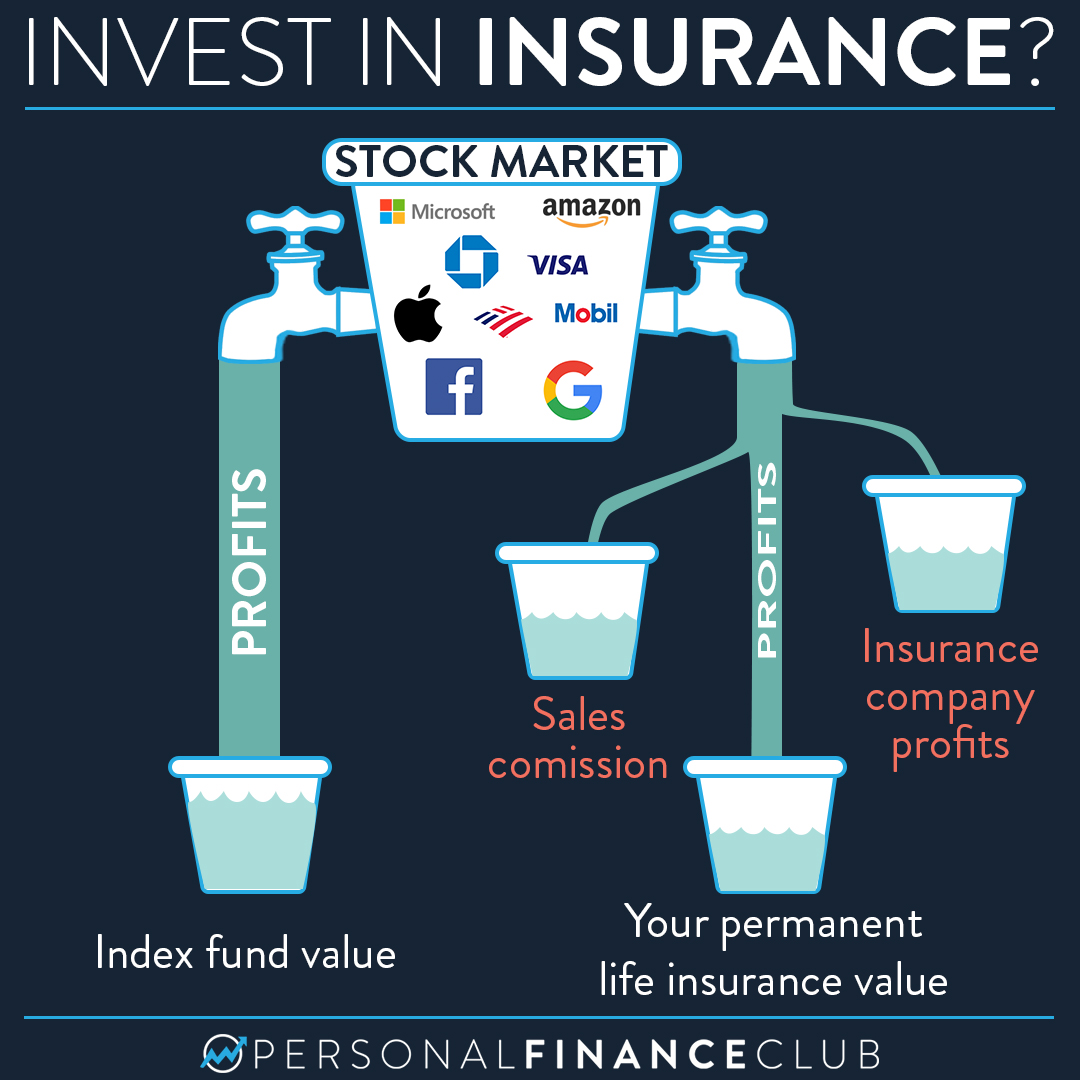

IUL agreements secure against losses while supplying some equity risk costs. IRAs and 401(k)s do not use the same drawback defense, though there is no cap on returns. IULs often tend to have actually have complicated terms and higher fees. High-net-worth people wanting to decrease their tax concern for retirement may gain from spending in an IUL.Some capitalists are far better off getting term insurance while optimizing their retirement strategy payments, instead of getting IULs.

While that formula is tied to the efficiency of an index, the amount of the credit scores is practically constantly going to be less.

Employers often supply matching payments to 401(k)s as a benefit. With an indexed global life policy, there is a cap on the quantity of gains, which can restrict your account's development. These caps have yearly top limits on account credit scores. If an index like the S&P 500 increases 12%, your gain might be a fraction of that quantity.

Iule

If you drop into this classification, take into consideration chatting to a fee-only economic expert to talk about whether getting permanent insurance fits your overall method. For several financiers, though, it might be better to max out on payments to tax-advantaged retirement accounts, particularly if there are contribution matches from a company.

Some plans have an assured price of return. One of the key features of indexed global life (IUL) is that it supplies a tax-free circulations.

Possession and tax obligation diversity within a portfolio is raised. Select from these items:: Supplies long-term development and revenue. Ideal for ages 35-55.: Offers versatile coverage with moderate cash worth in years 15-30. Ideal for ages 35-65. Some points customers need to think about: For the death benefit, life insurance policy products bill fees such as mortality and cost risk charges and surrender costs.

Retirement preparation is important to preserving economic safety and security and retaining a specific standard of life. of all Americans are bothered with "maintaining a comfy standard of living in retirement," according to a 2012 study by Americans for Secure Retirement. Based upon recent stats, this majority of Americans are justified in their issue.

Division of Labor approximates that an individual will require to keep their current requirement of living when they begin retired life. Additionally, one-third of U.S. home owners, in between the ages of 30 and 59, will certainly not be able to maintain their criterion of living after retired life, also if they postpone their retired life until age 70, according to a 2012 research study by the Staff member Advantage Research Institute.

Indexed Universal Life (Iul) Vs. 401(k): Which Is Better For Retirement?

In the same year those aged 75 and older held an ordinary financial obligation of $27,409. Amazingly, that figure had even more than doubled because 2007 when the typical financial debt was $13,665, according to the Worker Benefit Research Study Institute (EBRI).

Demographics Bureau. Moreover, 56 percent of American retirees still had superior financial obligations when they retired in 2012, according to a study by CESI Financial debt Solutions. What's even worse is that past research study has shown financial debt amongst senior citizens has actually been on the increase throughout the past couple of years. According to Boston University's Facility for Retirement Research, "In between 1991 and 2007 the variety of Americans between the ages of 65 and 74 that declared personal bankruptcy increased an amazing 178 percent." The Roth Individual Retirement Account and Plan are both tools that can be utilized to develop substantial retired life savings.

These monetary devices are similar in that they benefit insurance holders who want to produce financial savings at a lower tax obligation rate than they might come across in the future. Nonetheless, make each a lot more appealing for people with differing needs. Determining which is much better for you depends upon your individual scenario. In either situation, the plan expands based upon the rate of interest, or returns, attributed to the account.

That makes Roth IRAs suitable financial savings cars for young, lower-income employees that reside in a lower tax obligation bracket and who will certainly gain from years of tax-free, compounded growth. Given that there are no minimum called for payments, a Roth individual retirement account offers capitalists regulate over their personal objectives and risk tolerance. Furthermore, there are no minimum needed distributions at any kind of age during the life of the plan.

a 401k for staff members and employers. To contrast ULI and 401K strategies, take a minute to recognize the fundamentals of both products: A 401(k) allows staff members make tax-deductible contributions and take pleasure in tax-deferred growth. Some companies will certainly match part of the worker's payments (iul mutual of omaha). When employees retire, they normally pay taxes on withdrawals as average earnings.

Financial Foundation Iul

Like various other irreversible life policies, a ULI policy additionally allots part of the costs to a money account. Because these are fixed-index policies, unlike variable life, the policy will certainly likewise have a guaranteed minimum, so the money in the cash money account will certainly not reduce if the index decreases.

Policy owners will likewise tax-deferred gains within their money account. www iul. Discover some highlights of the benefits that universal life insurance can use: Universal life insurance policy policies do not impose limitations on the size of plans, so they might give a means for employees to conserve even more if they have already maxed out the Internal revenue service limits for other tax-advantaged monetary items.

The IUL is much better than a 401(k) or an individual retirement account when it concerns conserving for retired life. With his almost 50 years of experience as an economic planner and retirement preparation specialist, Doug Andrew can reveal you precisely why this is the instance. Not just will Doug explains why an Indexed Universal Life insurance agreement is the much better car, however additionally you can likewise learn how to optimize properties, decrease taxes and to empower your genuine riches on Doug's 3 Dimensional Wealth YouTube channel. Why is tax-deferred accumulation much less desirable than tax-free accumulation? Find out just how postponing those tax obligations to a future time is taking a terrible threat with your financial savings.

Table of Contents

Latest Posts

Index Linked Insurance Products

Iul Insurance Meaning

Aseguranza Universal

More

Latest Posts

Index Linked Insurance Products

Iul Insurance Meaning

Aseguranza Universal